With Medicare Advantage enrollment on the rise, and an influx of plans for individuals to choose from, growth and success in the marketplace hinges on adaptability.

The market is becoming increasingly competitive and consumer demands are evolving. Growth depends on a health plan’s ability to adapt to better serve members – especially modern seniors – and focus on optimizing revenue realization, among other levers.

I presented on the importance of collaboration alongside Dr. John Fong, who was senior vice president and chief clinical officer for Senior Health Services within Blue Cross Blue Shield of Michigan at the time.

Dr. Fong mentioned at the summit that more programs are needed to support the 10,000 individuals turning 65 each day, but standards are going up and plans are finding it harder to achieve desirable Star Ratings.

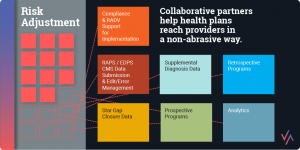

If health plans don’t connect with providers in a non-abrasive way, and if they don’t get the right incentive plans in place, they can only go so far.

Providers play a critical role in ensuring that members take advantage of preventive health services. And it’s no secret that strong provider relationships can lead to closing gaps in care and improving risk adjustment accuracy, among other benefits.

Providers play a critical role in ensuring that members take advantage of preventive health services. And it’s no secret that strong provider relationships can lead to closing gaps in care and improving risk adjustment accuracy, among other benefits.

It sounds simple, but if health plans don’t connect with providers in a non-abrasive way, and if they don’t get the right incentive plans in place, they can only go so far.

BCBSM’s Senior Health Services, for example, wasn’t getting what it needed from its prospective programs.

“We had to find a way to get closer to providers if we were going to make a real impact, but we couldn’t do it without a collaborative partner,” Dr. Fong said. “That’s where Advantasure comes in.”

Working directly with provider offices, Advantasure’s provider engagement coordinators ensure that strategies around risk and Star improvement are embedded into the regular workflow, in addition to regularly reinforcing educational topics. And thanks to the concurrent review of provider documentation, any deficiencies that might exist are quickly identified and addressed.

The result is enhanced risk score accuracy, increased Star Ratings, improved condition documentation, reduced RADV audit risk and, most importantly, better member care.

While 62 percent of care gaps addressed by physicians were resolved, there was only a 40 percent success rate among cases where physicians did not address care gaps with BCBSM Senior Health Services’ members, according to the company.

Additionally, risk scores are consistently more accurate for BCBSM members engaged in the Provider Engagement Coordination program than for members in traditional retrospective and in-home assessment programs.

Right now, Medicare’s population and cost structure enables us to work closely with providers and reach all members. Moving forward, as commercial models begin to look more like Medicare, we’ll be able to bring similar programs to that space. Ultimately, everybody wins with a less abrasive and more cost-effective program.